Biden Pause on American LNG will Slow Economic Growth, Boost Emissions and International Adversaries

WASHINGTON – In a move designed to assuage climate activist groups, the Biden Administration has announced a pause on all pending approvals of U.S. liquid natural gas (LNG) export permits – a decision that will slow the growth of U.S. LNG and could push American allies further into the hands of America’s adversaries, including Russia and Iran. Additionally, while hailed as a victory by climate advocacy groups, the decision could ultimately increase total global emissions, with U.S. LNG having 50% lower supply chain emissions than Russian natural gas. Natural gas has been the single biggest factor in reducing U.S. greenhouse gas emissions and could have the same effect around the world.

“Shortages of American natural gas on the global market will result in higher energy costs for America’s allies, energy shortages in the developing world and dramatically higher profits for American adversaries like Russia,” said AGA President and CEO Karen Harbert. “The United States should not undercut our allies or fund our enemies with a policy that will increase global emissions and hamstring an engine of economic growth. Freezing approvals for LNG export terminals should be reconsidered immediately.”

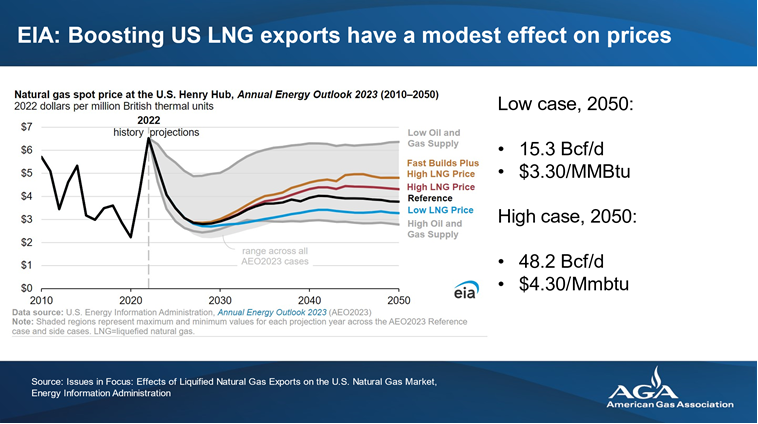

While some advocates against increasing LNG exports have suggested that sending more natural gas overseas could increase domestic prices for U.S. consumers, the government’s own data disproves that theory. Analysis from the U.S. Energy Information Administration suggests that boosting LNG exports would have a minimal impact on U.S. prices thanks to the significant quantities of natural gas available in the United States.

Freezing American LNG export permits will also have a slowing effect on U.S. economic growth, taking away significant potential job growth while handing an economic victory to America’s adversaries overseas. Exports of LNG act as a stabilizing pull factor, with demand that encourages producers to avoid sharply reducing production when faced with low domestic prices. See a graph of EIA’s analysis below.