Natural Gas Market Indicators – January 30, 2025

Natural Gas Market Summary

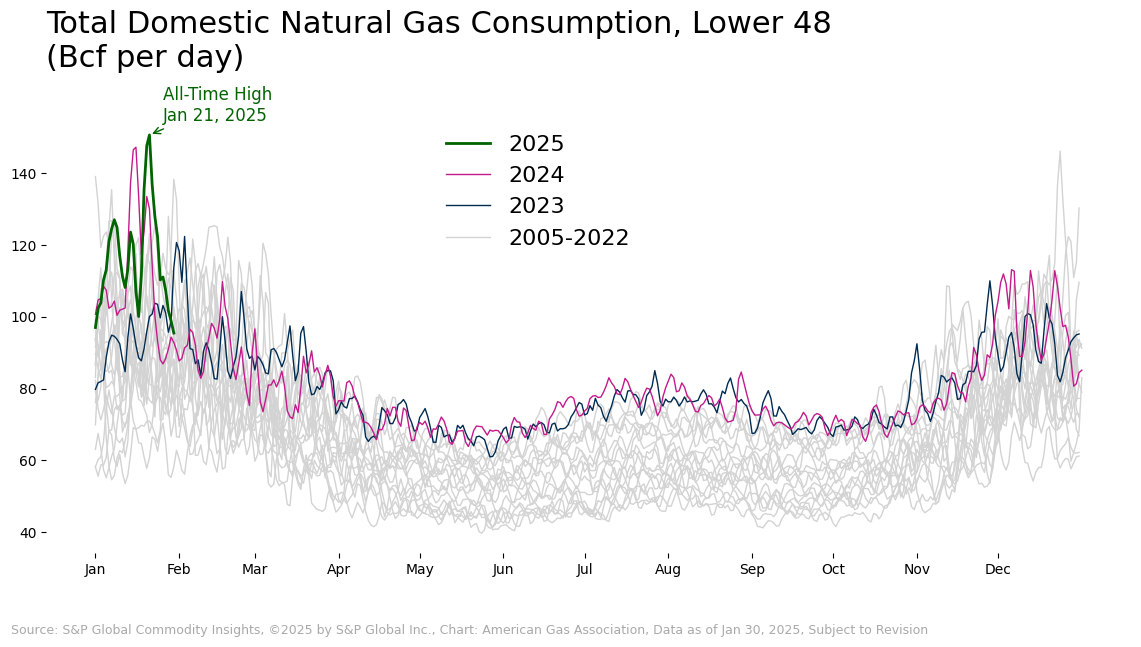

The U.S. natural gas market has begun 2025 in record territory. To date, this January has been the coldest in more than three decades, based on gas-weighted HDDs. As of January 28, cumulative HDDs for the lower-48 states total 982, making it the fifth highest since 1982 and the highest since 1994. Additionally, the recent Arctic blast pushed lower-48 natural gas demand above 183 Bcf (Updated 4/8/24) on January 21—an all time high. Such daily volumes that were perhaps once unimaginable now reflect the continued growth of domestic natural gas requirements for and the rising influence of exports.

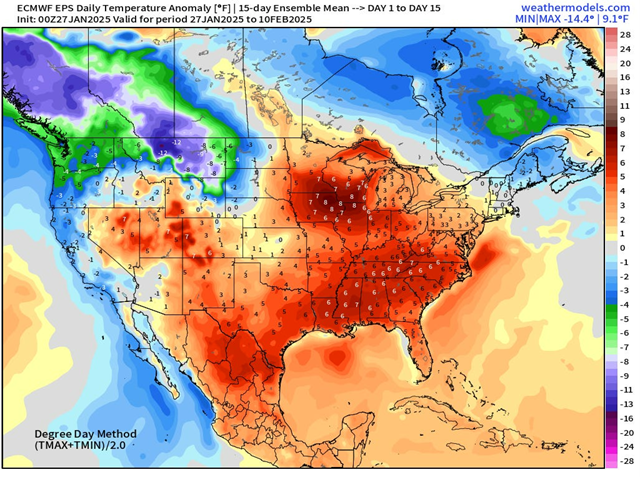

In the short-term, however, daily consumption has eased since last week’s polar vortex. A milder weather forecast may temper demand within the natural gas market as the U.S. moves into the last two months of the 2024-2025 winter heating season. According to WeatherTrader, the 15-day average temperature anomaly is expected to be between 1 and 7 degrees Fahrenheit warmer for much of the lower-48 through February 10. Exceptions are the West Coast, Northern states from the Pacific Northwest into the Midwest, and Maine, with average anomalies up to 12 degrees Fahrenheit cooler in some areas.

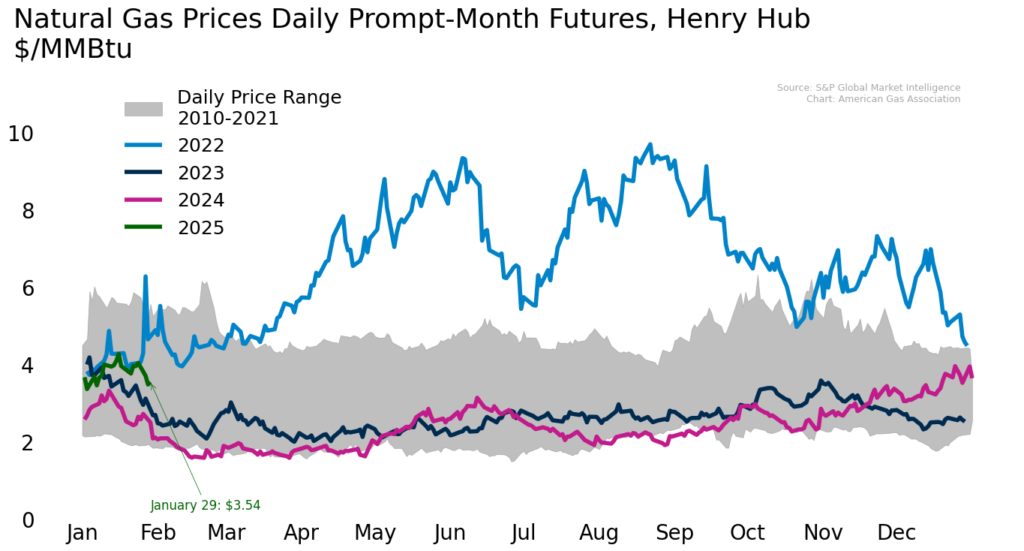

Amid the milder forecast, futures prices have softened and natural gas demand has returned to pre-Arctic Blast levels. Total weekly natural gas demand, including exports, for the week ending January 30, fell 15.7 percent week-over-week, according to preliminary data from S&P Global Commodity Insights. Futures prices appear to have responded accordingly. On January 29, February prompt month Henry Hub prices closed 3.4 percent lower than the first trading day in January 2025 and down 17 percent from the near-term high on January 16.

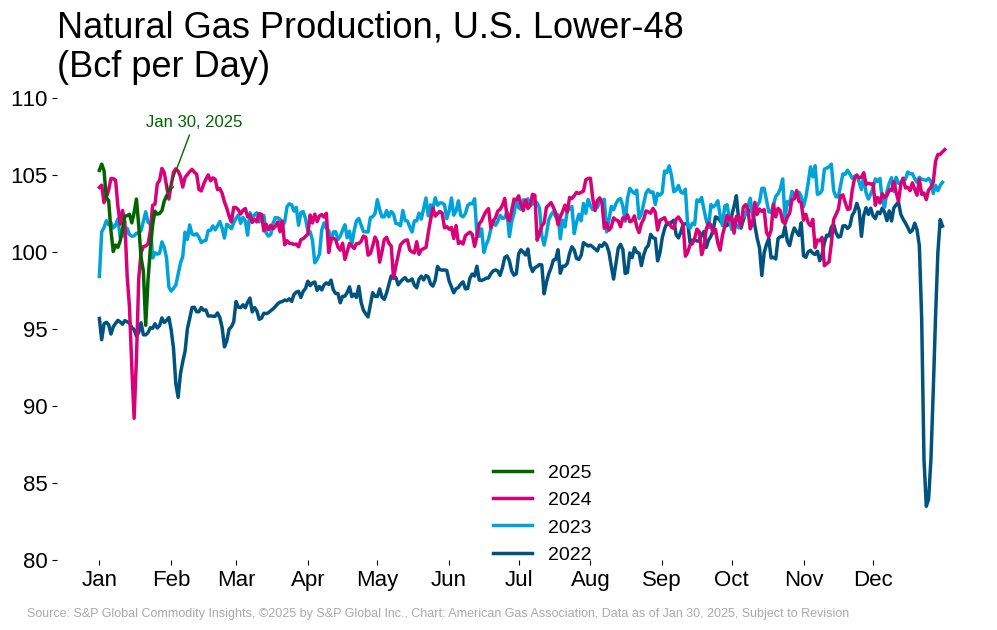

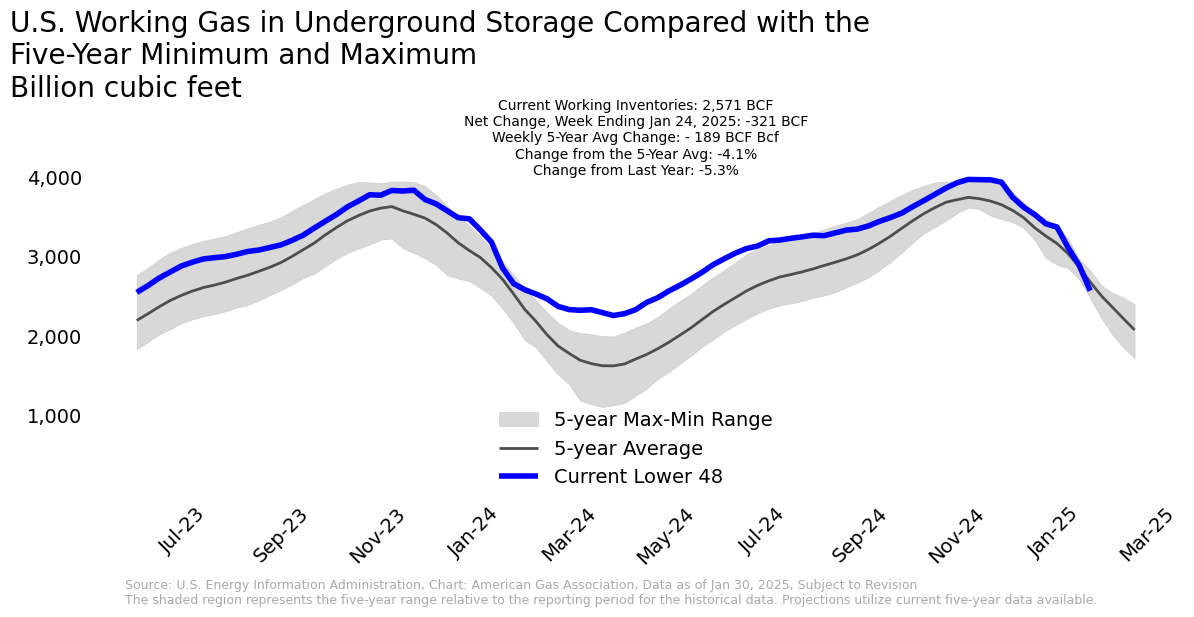

On the supply side, natural gas production is experiencing a slow recovery from weather-related declines. As of late January, production has returned to the levels before the freeze-offs associated with Winter Storm Enzo, but remains below levels experienced at the start of 2025. For the week ending January 30, preliminary data from S&P Global Commodity Insights indicates production is 3.1 percent higher than the prior week but still lags the same period last year by 1.5 percent. Regionally, the Midwest and Southwest are leading production recovery, increasing by 7 percent and 6.6 percent, respectively, while production is down 0.7 percent in the Southeast. Additionally, storage inventories have fallen below the five-year average, but the mild forecast and recovering production levels may keep bullish pricing sentiments at bay.

Warmer Forecast, Falling Prices

February 2025 Henry Hub futures prices have declined following the Arctic Blast. According to CME data, futures settled at $3.54 per MMBtu on January 29, decreasing 16.3 percent after a seasonal peak at $4.23 per MMBtu on January 16. Into March and April, futures contracts show further price declines below $3.20 per MMBtu, indicating bearish sentiments toward the end of the winter heating season relative to current levels. Declining futures prices are likely related to the anticipated weather forecast and resulting demand trends, while storage inventories below the five-year average continue to support levels above 2024 prices.

Regionally, day ahead price data from S&P Global Market Intelligence indicates that spot prices fell at most locations between January 23 and 29, ranging from a decrease of $12.52 per MMBtu at Transco Zone 5 to an increase of $5.56 per MMBtu at Dominion North. Over this period:

- Prices at the Houston Ship Channel fell from $3.25 per MMBtu on January 23 to $2.87 per MMBtu on January 29 as temperatures in Texas recovered from the Arctic Blast

- Prices also declined along the West Coast, reaching $3.70 per MMBtu at PG&E, $4.16 MMBtu at SoCal Citygate, and $2.47 per MMBtu at Northwest Sumas on January 29

- In the Southeast and Northeast, prices fell at all locations except Dominion North, where prices increased by $5.56 per MMBtu

Additionally, spot prices at Transco Zone 6 NY fell from $15.16 per MMBtu on January 23 to $3.55 per MMBtu on January 29, recovering from high prices that occurred during the Arctic Blast. The EIA reports that spot prices at Transco Zone 6, reached a high of $97.90 per MMBtu on January 17, the third highest nominal price since February 1998. The price surge occurred prior to the Arctic Blast due to its potential to reduce production and cause pipeline constraints. Falling prices at Transco Zone 5 between January 22 and 29 may also be linked to this recovery.

Mixed Weather Forecasts Across the U.S.

According to National Oceanic and Atmospheric Administration (NOAA) projections, Southern and Eastern states may have a reprieve from frigid weather in early February. According to NOAA’s January 29 temperature probability map, several of the states in the Southwestern, Southern, Mid-Atlantic, and Northeastern regions could experience above-normal temperatures through February 12. By contrast, a cold front is expected to keep temperatures below normal along the West Coast and into much of the Midwest.

For the week ending January 25, weather in the U.S. was 26.5 percent colder than both last year and 30-year normal temperatures, according to heating degree days (HDDs). With the exception of the Pacific, all regions experienced colder-than-normal weather during this time. Since the week ending October 4, all regions except the East South Central, West South Central, and Mountain regions have experienced colder weather than last year.

Consumption Softening on Milder Weather, Still Exceeding Last Year

The EIA reports that domestic natural gas consumption rose by 9.3 Bcf per day for the week ending January 22, an increase of nearly 8 percent over the previous week. This increase was primarily driven by a 10.3 percent (5.6 Bcf per day) increase in demand for the residential/commercial sectors that coincided with the below-average temperatures during this time. Demand in the power sector increased more than 8 percent (3.1 Bcf per day) while industrial sector demand increased nearly 2 percent (0.5 Bcf per day). Regionally, domestic consumption increased the most in the Rockies (26.7 percent), Northwest (12.7 percent), and Midcontinent (11.5 percent) during this period.

Preliminary data from S&P Global Commodity Insights suggests domestic natural gas consumption for the week ending January 30 was down nearly 18 percent compared to the previous week due to milder weather. Year-over-year, U.S. consumption was up 17.7percent for the week relative to the same period last year, while regional year-over-year increases ranged from 2.2 percent in Texas to 33.7 percent in the Rockies.

According to the EIA, year-over-year for the week ending January 22:

- Power sector demand is down nearly 4 percent

- Residential and commercial sector demand is down 0.3 percent

- Domestic consumption is down just over 1 percent

- Industrial sector demand posted a gain of 0.7 percent

Production Levels See Recovery

Production levels are recovering after Winter Storm Enzo and freezing temperatures across the lower-48. According to data from S&P Global Commodity Insights, average daily production increased 3.1 percent for the week ending January 30. Compared to the same period last year, production is down 1.5 percent.

Regionally between January 24 and 30:

- Daily production levels increased in all regions

- Production increased the most in the Southwest, Midwest, and Texas, rising by 5.7 percent, 2.5 percent, and 2.2 percent, respectively

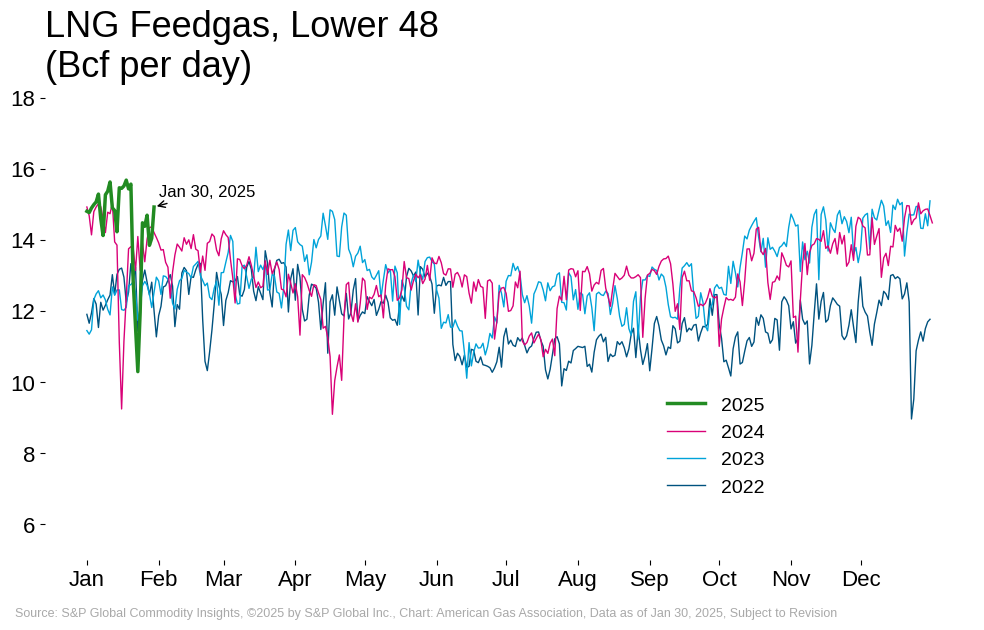

LNG Exports Recovering from Cold Weather Setback

According to the EIA, a total of 22 LNG vessels with a combined carrying capacity of 84 Bcf departed the U.S. between January 16 and 22, including one vessel from the recently opened Plaquemines Phase 1 export terminal. Average feedgas deliveries for the week fell 3.4 percent relative to the prior week according to S&P Global Commodity Insights data, likely due to weather-related flow impacts. For the week ending January 30, preliminary data suggests feedgas flows are up 1.5 percent week-over-week.

Daily feedgas delivery volumes have surpassed the month-to-date average as of January 30, likely supported by Freeport LNG returning to full operations following an outage due to issues with power supply during Winter Storm Enzo. On January 28, Venture Global was given permission to introduce natural gas into the seventh block of its Plaquemines facility. Venture Global has previously stated that the entire facility will not be commissioned until 2027, but the new block will cement Venture Global as the second largest US exporter of LNG.

Additionally, Bloomberg reports that rates for LNG freight vessels fell below $10,000 on January 23, driven by increased vessel availability outpacing delayed export projects. The lower costs could benefit both natural gas importers and traders.

European storage facilities have seen significantly faster drawdowns this winter than over the past two winters. As of the third week of January, inventories were 59 percent full, compared to 79 percent and 75 percent full over the same week in 2023 and 2024, respectively. Reuters reports that the low storage levels could result in a need for an additional 100 cargoes over the summer.

According to data from S&P Global Commodity Insights:

- For the week ending January 22, LNG feedgas was 17 percent higher than the same period last year

- LNG feedgas reached a new daily record on January 18, beating several other records in January 2025 to date

- Prior to January 2025, the previous record set on December 17, 2023, was 3.6 percent lower than the January 18 record

Storage Inventories Fall Below Five-Year Average

The EIA reports net withdrawals of 321 Bcf for the week ending January 24, the fourth time in history that the EIA has ever reported underground storage withdrawals exceeding 300 Bcf, and the largest withdrawal to date in the 2024-2025 winter heating season. Storage inventories now sit at 2,571 Bcf, 11 Bcf below the five-year average and 144 Bcf below inventory levels last year. The largest week-over-week withdrawal occurred in the South Cental region (136 Bcf), and the Mountain region set an all-time withdrawal record of 17 Bcf. In all regions except the Mountain and Pacific, storage inventories are below the five-year average.

Exports to Mexico Soar Year-Over-Year

For the week ending January 22, net imports from Canada increased 0.7 Bcf per day or 8.7 percent over last week, according to the EIA. By comparison, exports to Mexico fell by 1.5 percent or 0.1 Bcf per day. Net Canadian imports increased quickly in early 2025 as much of the U.S. faced below-normal temperatures and winter storms that increased demand and softened production, reaching a near-term high on January 21.

According to EIA for the week ending January 22, year-over-year:

- Canadian imports are down 2.2 percent

- Exports to Mexico are up 11.7 percent, which may be attributed to growing domestic demand for natural gas for power generation and LNG feedgas in Mexico

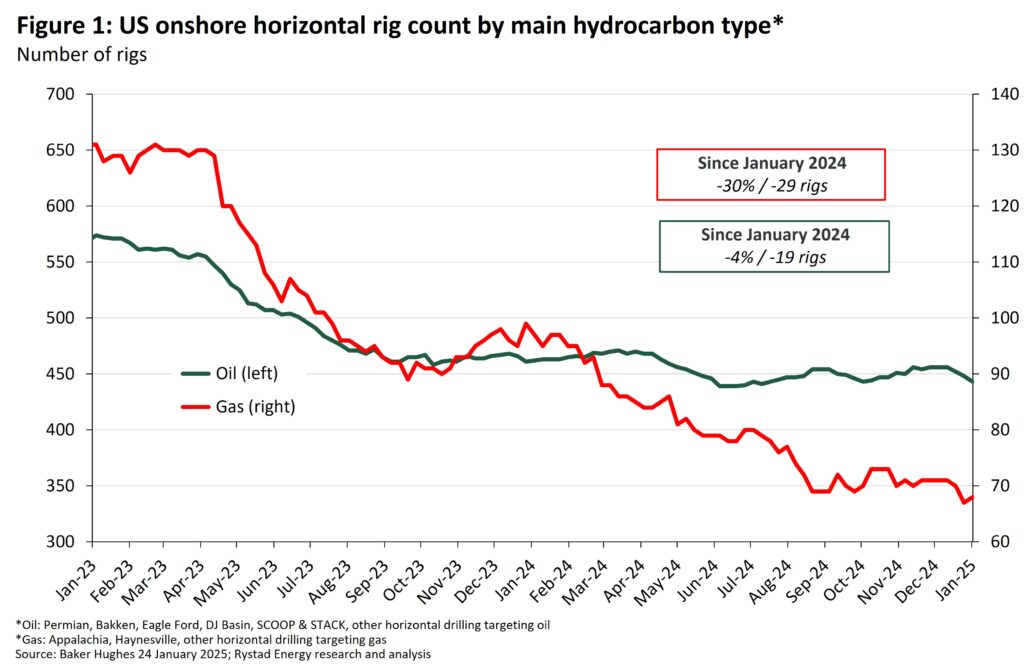

Natural Gas Rig Activity

Baker Hughes reports 99 natural gas rigs for the week ending January 24, a 1 percent increase from last week and a 16.7 percent decline compared to last year. Oil-directed rigs decreased year-over-year by 27 rigs or 5.4 percent. Additional analysis from Rystad Energy indicates that the U.S. horizontal rig count has declined every week so far in January, primarily driven by reductions in the Permian Basin. Since January 2024, onshore horizontal gas and oil rigs have decreased by 30 percent and 4 percent, respectively.

What to Watch:

- Prices: Will bearish pricing sentiment continue if mild weather persists?

- Storage: Inventories have fallen below the five-year average. How will this impact prices into refill season?

- Supply: Will warmer temperatures and reduced storage levels encourage continued recovery of natural gas production?

For questions please contact Juan Alvarado | jalvarado@aga.org, Liz Pardue | lpardue@aga.org, or Lauren Scott | lscott@aga.org

To be added to the distribution list for this report, please notify Lucy Castaneda-Land | lcastaneda-land@aga.org

NOTICE

In issuing and making this publication available, AGA is not undertaking to render professional or other services for or on behalf of any person or entity. Nor is AGA undertaking to perform any duty owed by any person or entity to someone else. Anyone using this document should rely on his or her own independent judgment or, as appropriate, seek the advice of a competent professional in determining the exercise of reasonable care in any given circumstances. The statements in this publication are for general information and represent an unaudited compilation of statistical information that could contain coding or processing errors. AGA makes no warranties, express or implied, nor representations about the accuracy of the information in the publication or its appropriateness for any given purpose or situation. This publication shall not be construed as including advice, guidance, or recommendations to take, or not to take, any actions or decisions regarding any matter, including, without limitation, relating to investments or the purchase or sale of any securities, shares or other assets of any kind. Should you take any such action or decision; you do so at your own risk. Information on the topics covered by this publication may be available from other sources, which the user may wish to consult for additional views or information not covered by this publication.

Copyright © 2025 American Gas Association. All rights reserved.