Special Edition: Natural Gas Market Indicators – January 24, 2025

Record Natural Gas Demand During Winter Storm Enzo

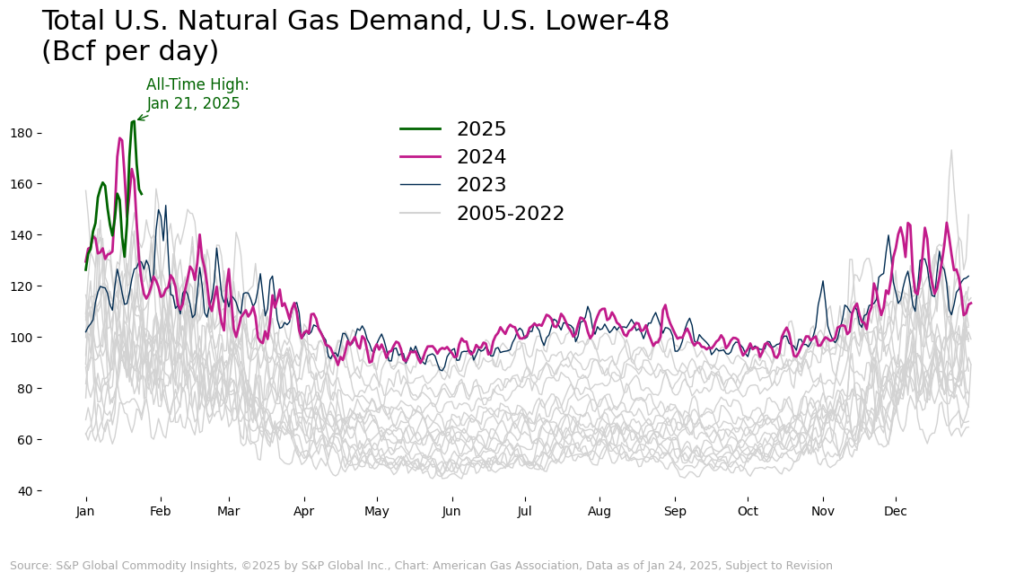

Historic weather conditions drove U.S. natural gas demand to record levels this week. Back-to-back days saw unprecedented domestic natural gas consumption on January 20 and 21 as heating needs surged across buildings and industry and due to increased demand from the power sector. Including exports, natural gas demand reached 184 Bcf on both January 20 and 21, according to preliminary data from S&P Global Commodity Insights.

The industrial sector saw historic two-day highs, with demand reaching 29.2 Bcf on January 21. In the power sector, daily consumption hit an all-time winter record of 50.4 Bcf on January 21.

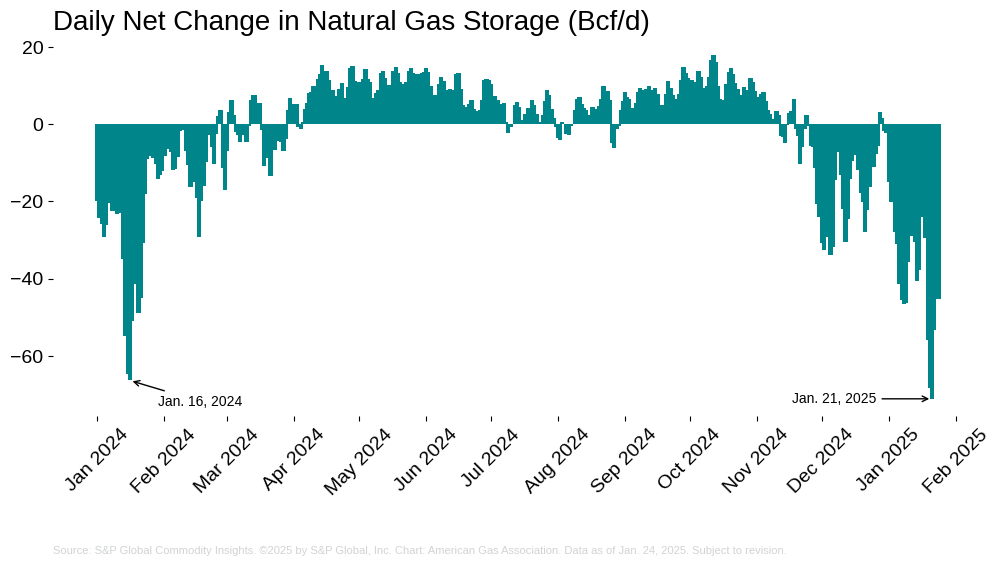

To meet this heightened demand, daily storage withdrawals surged. Preliminary data indicates that January 21 posted the highest daily withdrawal on record, reaching 71.2 Bcf. As a percentage of total demand, storage withdrawals accounted for approximately 40 percent of lower-48 natural gas deliveries on January 21.

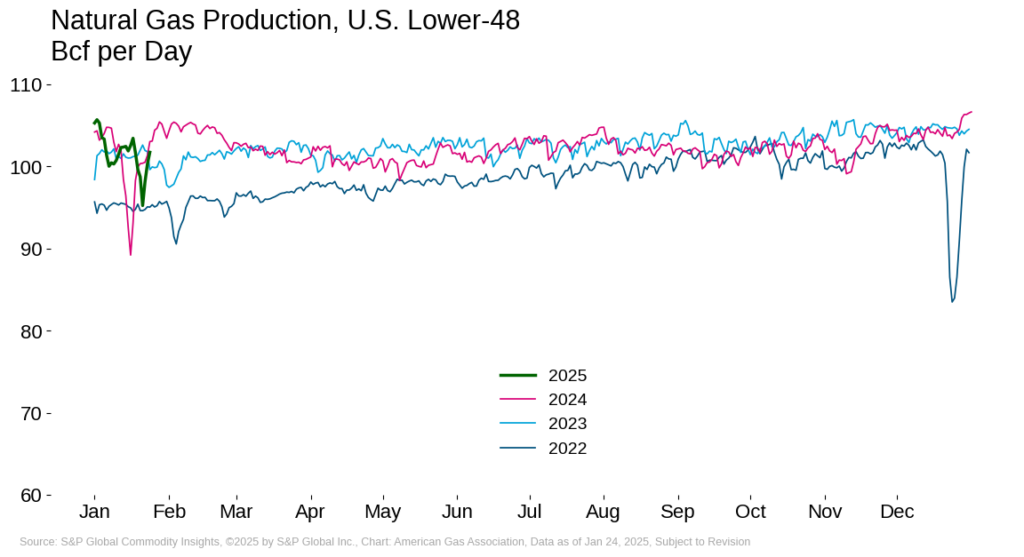

Natural gas production saw temporary declines during the Arctic blast, suggestive of well-head freeze-offs in some regions, dropping 8 percent at its low point on January 21 relative to production levels before the event. However, flowing dry gas production is already increasing as temperatures ease, with preliminary estimates showing production above 100 Bcf per day as of this publication.. Net imports from Canada and some LNG sendout volumes in the Southeast and Northeast helped offset declines in flowing production to meet the historic levels of demand.

Prices Mixed as Cold Weather Continues

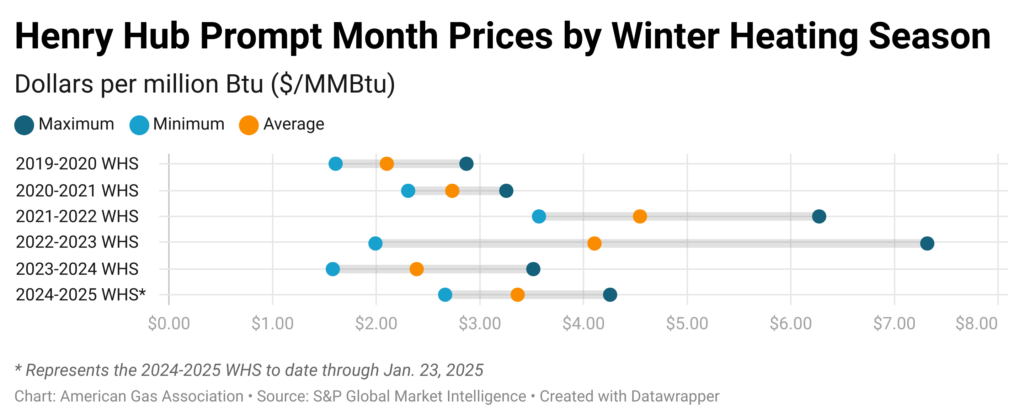

CME reports that the February prompt-month Henry Hub futures settled at $3.95 per MMBtu on January 23, down 7.4 percent from the two-year high set on January 16 but 7.8 percent higher than the first trading day in January. Natural gas futures have softened since January 16 on milder weather forecasts that are expected to improve production constraints and ease demand, according to Natural Gas Intelligence (NGI). However, the spot market saw some short-term increases. Ahead of the cold blast, Chicago Citygate prices reached nearly $10 per MMBtu on January 17, with NGI’s Midwest Regional Average reaching $8.87. Day ahead prices for January 21 at Henry Hub climbed to $9.86, according to S&P Global Market Intelligence. In the capacity-constrained Northeast, spot prices reached as high as $42.86 at Transco Zone 6 NY and $24.09 at the Algonquin City Gate. Looking to the futures strip, currently, the February prompt-month price as of January 22 is nearly 64 percent higher than the same day last year and nearly 15 percent higher than January 23, 2023.

Historic Weather Across Lower-48

The Arctic blast sweeping down from Canada and the Northern half of the U.S. combined with a low-pressure system along the Gulf Coast, bringing a generational winter storm event to the South and frigid temperatures across the Lower 48. Between January 20 and 22, Winter Storm Enzo brought heavy snowfall and icy conditions to the South, reaching from Houston to the Florida panhandle. Many areas saw more snow than recorded in the last 130 years, with over 10 inches of snowfall in New Orleans and at least 8.8 inches of snowfall in Milton, Florida.

Meanwhile, the Arctic blast caused extreme, low temperatures across the U.S. On the evening of January 20, the average temperature in the Lower 48 was 18.2 degrees Fahrenheit at 6:30 PM Eastern time, leaving 213 million people in below-freezing temperatures and 15 million in subzero conditions, according to Weather Trader. Through January 23, multiple cold weather alerts were issued across the country by the National Weather Service, with temperatures dropping between 10 to 40 degrees below average and windchills reaching negative 30 degrees in some regions. Temperatures began to ease nationally by Thursday, January 23. Between January 31 and February 6, the National Oceanic and Atmospheric Administration’s temperature outlook forecasts above-average and near-normal temperatures across most of the U.S. Over the same period, Alaska and some Western states may expereince below-normal temperatures. Potential precipitation could greatly benefit the extremely dry West Coast.

Record Consumption Levels

Domestic demand rose from about 120 Bcf per day on January 17 to above 165 Bcf on January 21, reflecting the rapid onset of cold and the concurrent ability of the natural gas system to ramp up deliveries to meet heating demand. Lower-48 domestic natural gas consumption increased by 19 percent between January 14 and January 21, driven by a 25 percent increase in residential and commercial sector consumption, a 29 percent increase in power sector use, and a 6.1 percent increase in industrial. Exports to Mexico decreased 4.6 percent during that period. Canadian imports played a critical role in meeting demand, increasing 27 percent to the second-highest daily level since 2008.

Record Highs:

- Total demand reached 184 Bcf on January 21, an increase of 0.3 percent over the previous record set on January 20.

- Industrial demand reached 29.2 Bcf on January 21, increasing 0.3 percent over the record set the day prior.

- Natural gas demand for power generation reached a winter record high of 50.4 Bcf Bcf on January 21 as electricity demand soared in several regions.

- PJM set a new winter record for electricity demand on January 22, with a peak load of 145,000 MW and 8,000 MW in exports, surpassing the previous record of 143,700 MW. Natural gas was responsible for 44.8 percent of the generation during the peak hour. For January 22, PJM was forecasting a peak of 144,355 MW.

Natural Gas Production

Data from S&P Global Commodity Insights indicates domestic dry natural gas production dropped during the current cold wave, suggesting localized well-head freeze-offs in some production areas. Dry gas production was down 2.9 percent for the seven days ending January 24 and 1.2 percent lower than the same period last year. Production fell as much as 8 at its low point relative to the production levels preceding the excessive cold.

Regionally over this period:

- Between January 17 and 22, dry gas production declined in the Southwest, Texas, and the Northeast, dropping by 8.0 percent, 6.7 percent, and 6.2 percent, respectively.

- Production fell in all other regions by at least 0.2 percent during this period.

- In North Dakota, reports indicate that extreme cold has reduced natural gas production by 370 to 450 Mcf per day as of January 21.

LNG Feedgas Flows Fall Week-Over-Week

LNG feedgas deliveries dropped 10.1 percent for the week ending January 24 and by 25.4 percent from January 17 to January 22, according to data from S&P Global Commodity Insights. Reduced flows are likely related to weather-induced outages such as Freeport LNG being taken offline due to power supply issues. However, it is currently unclear to what extent Winter Storm Enzo has impacted U.S. LNG exports.

Storage Inventories Above Five-Year Average Prior to Storm

The most recent EIA storage report showed net storage withdrawals of 223 Bcf for the week ending January 17, a 7.2 percent decline in total working gas stocks compared to the previous week. Inventories of 2,892 Bcf are 1.9 percent lower than the same period last year and 0.7 percent higher than the five-year average. The weekly decline was primarily driven by withdrawals in the East and Midwest regions, where working gas volumes shrank by 8.4 percent and 7.9 percent, respectively. These regions also lagged storage inventories last year, while storage levels in the Mountain and Pacific regions are 15.7 percent and 14 percent higher, respectively. The South Central region realized a 6.9 percent drawdown week-over-week as of January 17 and is currently less than 1 percent higher than last year’s levels.

Preliminary data from S&P Global Commodity Insights indicates that storage levels may have fallen below the five-year average following Winter Storm Enzo. During the storm, single-day storage withdrawals reached a new record on January 21 in response to increased cold weather demand. On January 21, storage withdrawals exceeded the previous single-day record set on January 1, 2018, by 2.3 percent.

For questions please contact Juan Alvarado | jalvarado@aga.org, Liz Pardue | lpardue@aga.org, or Lauren Scott | lscott@aga.org

To be added to the distribution list for this report, please notify Lucy Castaneda-Land | lcastaneda-land@aga.org

NOTICE

In issuing and making this publication available, AGA is not undertaking to render professional or other services for or on behalf of any person or entity. Nor is AGA undertaking to perform any duty owed by any person or entity to someone else. Anyone using this document should rely on his or her own independent judgment or, as appropriate, seek the advice of a competent professional in determining the exercise of reasonable care in any given circumstances. The statements in this publication are for general information and represent an unaudited compilation of statistical information that could contain coding or processing errors. AGA makes no warranties, express or implied, nor representations about the accuracy of the information in the publication or its appropriateness for any given purpose or situation. This publication shall not be construed as including advice, guidance, or recommendations to take, or not to take, any actions or decisions regarding any matter, including, without limitation, relating to investments or the purchase or sale of any securities, shares or other assets of any kind. Should you take any such action or decision; you do so at your own risk. Information on the topics covered by this publication may be available from other sources, which the user may wish to consult for additional views or information not covered by this publication.

Copyright © 2025 American Gas Association. All rights reserved.