What’s Driving Historically Low Natural Gas Prices?

On July 29, August 2024 futures prices for natural gas at the Henry Hub expired with a final price of $1.91 per MMBtu – about 1/5th of what commodity traders in Europe are obliged to pay, and less than 1/6th the price of natural gas in Asian markets. This is the lowest August settlement price since trading of this contract began twelve years ago.

What’s driving these historically low prices, and how are American natural gas customers benefitting?

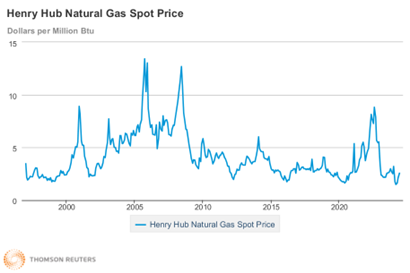

Brief context for those who haven’t been tracking this closely: the Henry Hub, located in Erath, Louisiana, is a central nexus where many natural gas pipelines come together, and where natural gas is bought and sold as a commodity, with contracts offered for future months and traders bidding based on what they expect the true value of natural gas will be when the future becomes the present. As the natural gas hub with the most trading volume in the United States, the Henry Hub represents a key index with respect to North American natural gas pricing. When you see an article referring to generic ‘natural gas prices,’ it is likely referring to the price per MMBtu at the Henry Hub. The prices over the last few decades are charted in weekly increments below for context.

The current low commodity prices are influenced by multiple trends, both short and long-term.

The Shale Revolution made it possible to access the vast reserves of natural gas (currently estimated at about 3,978 trillion cubic feet of technically recoverable reserves, or more than a century of supply at today’s demand levels) previously trapped in shale formations. With the start of the shale revolution came intense competition, encouraging rapid innovation to develop new techniques to extract natural gas more affordably, quickly, and efficiently. Some consolidation has occurred among operators, allowing the valuable knowledge gained from the initial scramble to be combined with other companies, and creating a group of highly innovative companies that bring together the best techniques and technologies.

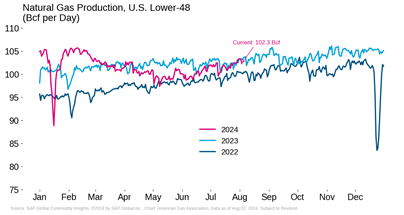

Abundant newly accessible natural gas resources, combined with numerous competitors and low cost of extraction, have created an environment where producers can turn a profit at historically low prices, survive downturns, and rapidly turn on and off wells as market conditions dictate. Hard earned experience and new technologies have lowered exploration risk, allowing producers to be more confident that a given well will pay off, and making it easier to rapidly increase or decrease drilling and completion activity in response to changing market conditions. This has largely translated to low and relatively steady natural gas prices over the past decade and a half. Because of these American companies, the United States has surged to become the single top natural gas producer in the world, producing nearly a quarter of all natural gas produced worldwide, with an estimated production of 36.4 trillion cubic feet in 2023. This is more than the 2nd and 3rd place producers, Russia and Iran, combined. Here’s how this year’s production compares to the last two years:

You’ll notice production is up. Natural gas producer EQT previously announced a strategic curtailment in production around the $1.50 per MMBtu mark, but slightly higher prices (a little over $3 per MMBtu in early June, in a testament to the ability of weather to move markets and shape expectations in the short run) during summer heat waves appear to have been enough of a signal for producers to bring more production back online.

Alright, so U.S. ascendance as an energy superpower capable of extremely affordable production is the biggest macro trend – no surprise there. The other main element is expectations. Meaning, as with other commodities, natural gas prices are shaped by supply and demand. Ideally, producers extract one unit of natural gas for each unit of expected demand to maintain balance in the market. When there’s an imbalance between supply and demand, markets typically adjust as producers either take production offline – sometimes, too much production, which can result in higher prices later – or curtail capital expenditure on future drilling and wait for demand to catch up to the lower prices.

Producers and potential consumers of natural gas frequently try to predict future supply and demand. Sometimes, this is easy. America has recently become the single top liquified natural gas (LNG) exporter in the world, increasing exports by 93.8% over the last decade. To export natural gas via ship, it must be chilled and liquified at LNG export facilities under low temperatures and high pressure before being loaded onto specialized tankers. These facilities take years to build – typically three to five years, but sometimes as long as ten. Because of strong global demand and contracts often measured in decades, these facilities typically operate at full capacity. This makes demand a relatively predictable factor, as producers can account for the expected volumes of new LNG export terminals and bring more wells online without a large impact on overall prices.

But even with the best planning and preparation, hiccups can arise. In 2022, an accident took the Freeport LNG export terminal and its 2.2 Bcf per day (equivalent to about 2.7% of U.S. natural gas consumption) offline, not coming fully back online until this month. New projects have also experienced unexpected delays. Golden Pass LNG in Texas (2 Bcf per day) saw its start date pushed back from 2024 to 2025, and it was announced that the Plaquemines terminal in Louisiana (4 Bcf per day) would undergo an extended commissioning process. While demand from other sources has been high – natural gas used for power generation has broken records in 2024 during recent heatwaves – it hasn’t been high enough to easily make up for the anticipated lost demand from LNG export terminals.

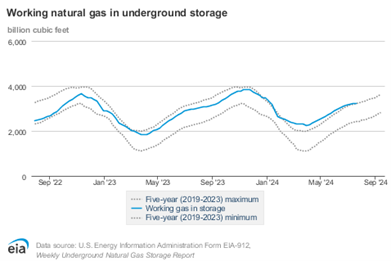

Freeport is back to normal operations, and despite disruption to the LNG market, the amount of natural gas in storage remains historically high, as seen in the chart below. As of July 19, there was 3,231 Bcf of working gas in storage, above the five-year maximum, and more than 800 Bcf above the five-year minimum.

The high storage levels have persisted despite hot weather driving record-breaking demand for natural gas used for power generation and a pace of injections well below last year’s levels. It’s only August, and there’s still time for continued high heat to bring storage levels down, potentially impacting prices. Thus far, however, high demand for summer cooling hasn’t impacted the large and steady supply of natural gas.

Low commodity prices are translating to lower natural gas bills for customers. While there hasn’t been time to collect 2024 data, the EIA estimated that this year’s inflation-adjusted residential natural gas prices will be the lowest in decades. Customers are reaping the benefits of lower commodity prices, with many AGA member companies filling rate cases with their regulators requesting permission to decrease customer bills. Our nation’s abundant supply of natural gas, and its consistent affordability are good news for customers. So whether you’re still thinking about sunscreen and sunhats or gearing up for school days and sweaters, know that your natural gas utility is working to support you and all the customers and communities they serve, with affordable and efficient energy every day.